You may have a critical level of financial stress and you may be feeling exhausted, anxious, defeated and hopeless.

Based on your answers to our questions you are in the ‘critical’ stage on the financial and mental wellbeing scale.

We're sorry things have been really tough for you recently. Many people experience money challenges, so please know that you are not alone. We are here for you.

You may be

Feeling troubled, sad or overwhelmed

Avoiding thinking about your financial situation

Having difficulty connecting with your family and friends

Feeling like you have low motivation to complete daily activities, or struggling to follow your normal routines

unmotivated and unable to complete daily activities

It's never too late to take action

If you’re experiencing money challenges and it’s affecting your mental wellbeing, it’s common to find yourself avoiding certain activities, like opening bills, answering the phone, or connecting with others.

While avoidance might make you feel better temporarily, it won’t help address the underlying issue, which can build up the more you avoid it.

It's best to take action to relieve the situation. It's never too late and you don't have to do it alone.

What you can do now for your mental wellbeing

What you can do now for your financial wellbeing

Talk or chat to a financial counsellor

Financial counselling offered by the National Debt Helpline is a free, independent service provided by skilled professionals who offer practical advice and support to people experiencing financial stress.

Financial counsellors can help you

- explore your options

- access eligible financial supports, concessions or grants

- negotiate with your creditors

- put plans in place to manage your debts/bills

- get your finances back under control.

Learn about other resources or services

Moneysmart is a government owned website that will help you take control of your money with free tools, tips and guidance.

Concessions and grants - Each state and territory government has a range of rebates and other assistance to help ease cost of living pressures. It is always worth checking what you’re eligible for.

- Way Forward – A free service that helps people in financial hardship get out of debt faster and avoid bankruptcy. They negotiate with creditors, establish budgets and provide debt repayment plans.

- Good Shepherd - Confidential service supporting people who have experienced financial abuse to feel more confident with money and plan for the future.

- Ask Izzy - An A-Z directory of community support services. These include emergency housing, meals, money, legal advice, domestic and family violence support and more.

- Foodbank - Links surplus food and groceries to people in need, across every state and territory in Australia.

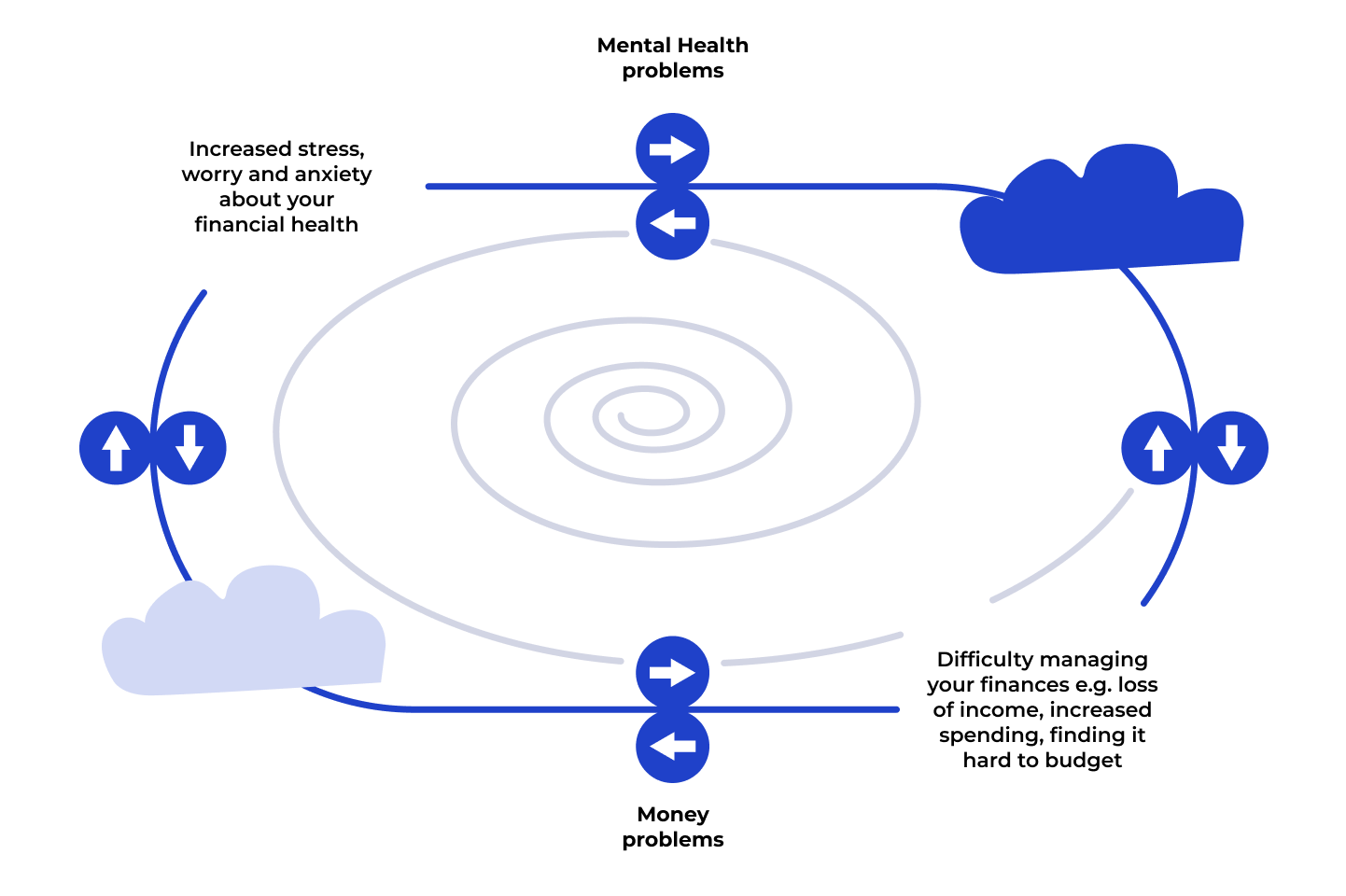

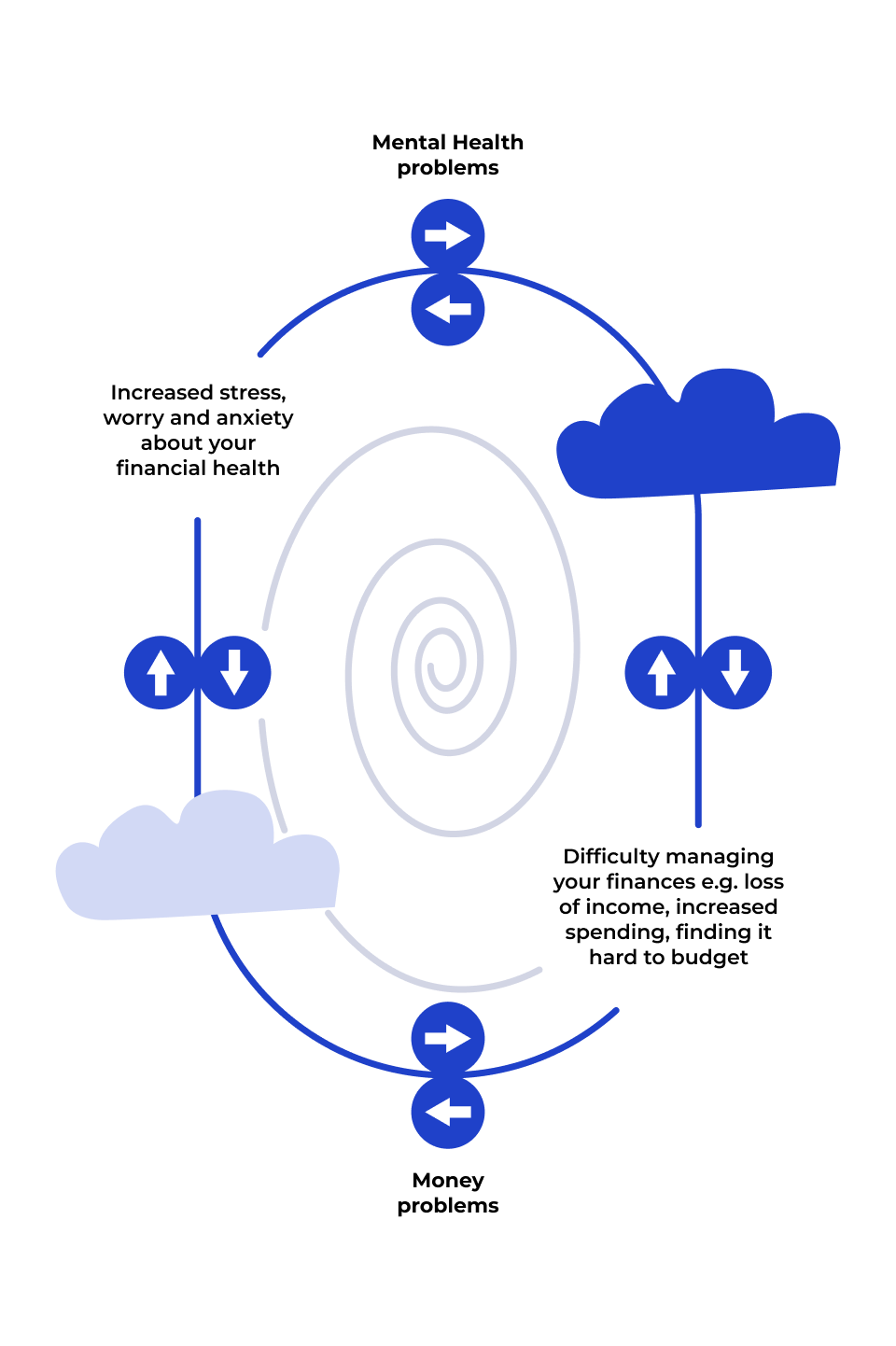

Financial wellbeing and mental health affect each other

Financial challenges can cause significant stress, which can impact our mental health. And the state of our mental health can make it harder to get on top of our finances.

There can be a lot of shame around talking about financial issues, especially when times are tough.

However, getting support to take control of your finances can bring a sense of relief, security and peace of mind.

It’s never too early or too late to seek support. If you’re experiencing financial stress or mental health challenges, we want you to know you’re not alone, and that help is available.

Gambling

Payday loans

Using credit to pay bills or debts

Buy now pay later schemes

Consumer leases

Alcohol & drugs

Financial abuse

Financial abuse is a form of family violence in which money and finances are used to coerce, control or hurt someone.

It can include many things, like controlling and preventing access to money, stopping someone from getting a job, forcing someone into unwanted loans, or sabotaging resources like housing, food, transport, study or employment.

Financial abuse can occur with other forms of violence and abuse.

1800RESPECT’s Financial Abuse Support Toolkit is available to anyone impacted by financial abuse.

Further resources

- Credit Smart - An online self-help resource designed by the Australian Retail Credit Association to help you understand credit reporting and how to view, control or repair your credit information.

- Financial difficulty - The Australian Banking Association has put together this detailed site with helpful information about how all Australian banks approach financial hardship.

- MoneyMinded - A community tool designed by ANZ to help you build your skills, knowledge and confidence in managing your money.