The rising cost of living and the impact on mental health

The cost of living crisis is having a significant negative impact on financial and mental wellbeing across Australia and other parts of the world.

If you're feeling stressed about money or cost of living pressures, know you're not alone. Help is available. The earlier you seek support, the less stressful your life will feel.

The link between financial and mental health

Experiencing a mental health problem may make it more difficult to manage your finances.

Similarly, struggling with financial difficulties, can increase the likelihood of developing a mental health problem.

Financial impacts

A recent Beyond Blue Survey found that 46% respondents named financial pressure as a key factor in their distress.1

Mental health impacts

Cost-of-living pressures can lead to stress, relationship problems, violence and feeling overwhelmed, and can result in negative coping strategies, such as over-working, alcohol and substance abuse.2

Prioritise your mental health

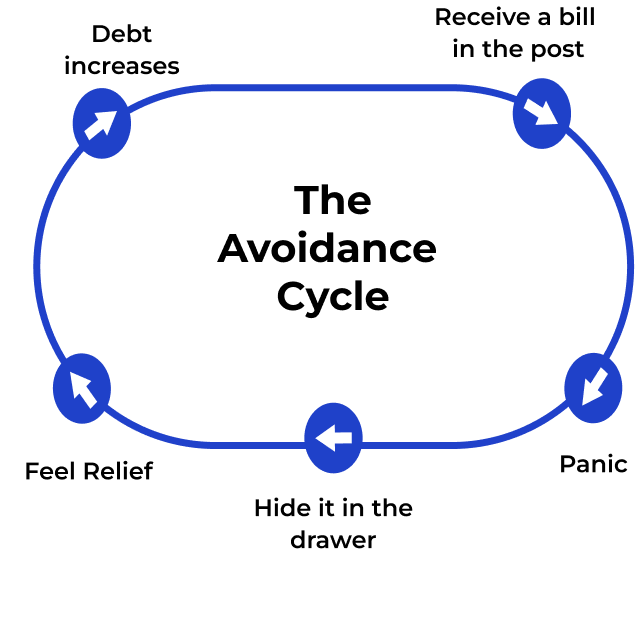

Its normal to avoid things that make us feel stressed or depressed. This is the avoidance cycle. Not thinking about a problem might make you feel better in the short-term but the problem doesn't disappear. It grows and becomes a bigger worry.3

Being persistently behind on payments and in long-term debt, can lead to feelings of shame.4 Over time, feeling shame or embarrassment about financial difficulties can lead to withdrawal from friends, family and colleagues, resulting in loneliness and isolation, and reluctance to reach out for support.5

- Out of work due to disability or illness

- Behind on debt repayments and bills

- Experiencing episodes of increased impulsive spending and memory problems, making it harder to keep on top of financial management

- Increased anxiety or stress about talking on the phone, going to the bank or opening your bills

- Depleted savings can erode people’s mental resilience and lead to increased feelings of anxiety

- Being unable to afford essentials such as food and heating, or to engage in social activities for long periods of time, can take an enduring toll on our mental health and drive feelings of isolation7

Long-term experiences of money and mental health problems aren’t inevitable.

If people receive timely and effective support, they can break the cycle between financial and mental challenges, stopping difficulties from becoming entrenched.

Money and mental health worries can really knock your confidence and self-esteem. During this time we also tend to stop our routines, including the ones that can make us feel better8:

Sleep

- Getting outside for a walk - it’s free and can bring down the pressure

Talking to someone

When to help someone

- Has no savings or cannot meet basic needs

- Has unmanageable debts, or avoiding financial institutions and creditors

- Has been contacted by debt collectors or received eviction notices

- Has negative credit history or at greater risk of financial abuse

- Outlook is feeling hopeless

- Is isolating and withdrawing from relationships

- Has very poor sleep, diet and not doing physical activity

- Unmotivated and unable to complete daily activities

When to help someone

- Don’t shame or judge them for the financial situation they find themselves in

- Do listen to them. Show empathy and compassion. Let them know that you are there for them

- Don’t try and solve their problem for them. Your conversation alone can make a big difference in helping them feel less alone and more supported

- Do encourage them to get help from a financial counsellor for their money problems. The easiest way to speak to a financial counsellor is to call the National Debt Helpline on 1800 007 007

- Do call Lifeline on 13 11 14 if you are concerned, they might be thinking about suicide and you aren’t sure how to talk to them

Learn more on the R U OK? website about talking to a mate who is stressed about finances or how to support someone experiencing financial pressures